- Ãëàâíàÿ

- Àâèàöèÿ è êîñìîíàâòèêà

- Àäìèíèñòðàòèâíîå ïðàâî

- Àêöèîíåðíîå ïðàâî

- Àíãëèéñêèé

- Àíòèêðèçèñíûé ìåíåäæìåíò

- Áèîãðàôèè

- Àâòîìîáèëüíîå õîçÿéñòâî

- Àâòîòðàíñïîðò

- Êóëüòóðà è èñêóññòâî

- Ìàðêåòèíã

- Ìåæäóíàðîäíîå ïóáëè÷íîå ïðàâî

- Ìåæäóíàðîäíîå ÷àñòíîå ïðàâî

- Ìåæäóíàðîäíûå îòíîøåíèÿ

- Ìåíåäæìåíò

- Ìåòàëëóðãèÿ

- Ìóíèöèïàëüíîå ïðàâî

- Íàëîãîîáëîæåíèå

- Îêêóëüòèçì è óôîëîãèÿ

- Ïåäàãîãèêà

- Ïîëèòîëîãèÿ

- Ïðàâî

- Ïðåäïðèíèìàòåëüñòâî

- Ïñèõîëîãèÿ

- Ðàäèîýëåêòðîíèêà

- Ðèòîðèêà

- Ñîöèîëîãèÿ

- Ñòàòèñòèêà

- Ñòðàõîâàíèå

- Ñòðîèòåëüñòâî

- Ñõåìîòåõíèêà

- Òàìîæåííàÿ ñèñòåìà

- Òåîðèÿ ãîñóäàðñòâà è ïðàâà

- Òåîðèÿ îðãàíèçàöèè

- Òåïëîòåõíèêà

- Òåõíîëîãèè

- Òîâàðîâåäåíèå

- Òðàíñïîðò

- Òðóäîâîå ïðàâî

- Òóðèçì

- Óãîëîâíîå ïðàâî è ïðîöåññ

- Óïðàâëåíèå

- Ñî÷èíåíèÿ ïî ëèòåðàòóðå è ðóññêîìó ÿçûêó

- Äðóãîå

Äîêëàä: Entrepreneurial project Individual ProjectÄîêëàä: Entrepreneurial project Individual ProjectMBA and EMBA Cover Sheet and Own Work Declaration Own Work Declaration I hereby certify that the following piece of work complies with the Own Work Declaration form already issued and with the University’s Rules and Regulations relating to plagiarism and collusion, as listed in the Essential Information for Students and the MBA Course Handbook. Candidate Number(s): Karimov A.A. Title of Course: EMBA 4: Entrepreneurial project Submission Date: 1 February 2008 Title of Work: Individual Project I confirm that all this work is my own except where indicated, and that I have: · Clearly referenced/listed all sources as appropriate · Referenced and put in inverted commas all quoted text (from books, web, etc) · Given the sources of all pictures, data etc that are not my/our own Not made any use of the essay(s) of any other student(s) either past or present · Not sought or used the help of any external professional agencies for the work · Acknowledged in appropriate places any help that I have received from others (eg fellow students, statisticians, external sources) · Complied with any other plagiarism criteria specified in the course handbook For group work, we certify that all members of the group have made a significant contribution. I understand that any false claim for this work will be reported to the Proctors and will be penalised in accordance with the University regulations. * delete as applicable SIGNED (insert candidate numbers) 54301

Development Project Business Plan Table of contents 3.2.Competitors and Competitive Advantages. 7 3.3.Target Market Segment Strategy. 9 3.4.Market Trends and Growth. 11 7.2.Project Earnings Structure. 20 7.3.Net Present Value Analysis. 21 7.5.Key Financial Indicators. 22 8.2.Management Team Gaps and Personnel Plan. 24 1.0. Executive Summary The investment project essence lies in creating in Kazan city (the capital of one of the Russian Federation regions – the Republic of Tatarstan) a state-of-the-art industrial park designed especially for small and medium-sized companies occupied in chemistry and petrochemistry. The choice of the industrial park profile is based on the regional economy structure and specialization. Fuel and petrochemical industries determine the republican economy profile. It is the production of crude oil, synthetic rubber, tyres (one third of total Russian market capacity), polyethylene (40% of total Russian market capacity) and wide range of petrochemicals processing; there are large mechanical engineering enterprises that produce helicopters, aircrafts and aircrafts engines, heavy trucks and small cars, compressors and oil-gas pumping equipment; hi-tech electric and radio devices. Globally, Tatarstan is one of the most economically developed republics of the Russian Federation, located in the centre of the country largest industrial region, at the intersection of most important highways, connecting East and West, North and South of the country. The project developer is the “Idea Capital Asset Management” company founded in 2004, which competes in real estate rental market, being a development and management company. Until recently it was occupied mainly in office real estate. With the HIMGRAD Industrial Park development project the company goes into industrial real estate market segment. The project is supposed to develop on the territory of an industrial site with 75 years history within the limits of Kazan city. The industrial park site covers 131 hectares in total. It is situated in the north-west industrial part of the city, a logistics juncture, close to one of the biggest republican chemical and petrochemical staff producer – the “Kazanorgsintez” plant. The building area exceeds 500 000 sq.m. Alongside with utilities and necessary production facilities the site residents will be provided with a comprehensive range of services along the whole value chain. The Market The industrial park has two different categories of target customers competing for their entrance to the site with local industrial premises proprietors and other Russian industrial parks: 1. local small and medium-sized companies, processing certain types of polymers, produced on the Republic of Tatarstan (one of the Russian Federation regions) territory, including the newly-established companies; 2. foreign medium-sized and big companies, processing certain types of polymers, produced on the Republic of Tatarstan territory. Russian economic performance remains robust for recent years. It provides good prospects for business development, especially in dynamically developing industries – such as real estate and petrochemistry. The “Himgrad” Industrial Park, combining the two main streams of business activity – real estate development and petrochemistry, ought to embrace the growth potential of these two industries. The Strategy The project aims at providing the following types of services: lease, utilities and additional services. According to the industrial site development concept, first, the residents sign a long-term lease agreement and enter into commitment to invest a certain sum of money in production facilities development within industrial park territory. The utilities are necessarily provided to the residents on preferential terms, priced below market rates. After a resident’s project enters full production capacity, he may buy the leased premises out. Besides lease and utilities, the site residents may take advantage of additional services. The customer-oriented service portfolio constitutes one of the core advantages of the site, especially valuable by small and medium-sized companies, generally possessing insufficient financial resources for organizing self-dependent raw-materials supplies at low prices, conducting large-scale marketing researches, necessary for their business further development and for defining additional areas of business expansion, etc. Our company goal is “to form a unique business environment, assisting the residents in their efficient development on a long-term basis”. Moreover, providing favourable conditions for marginal processing of chemical and petrochemical production on the Republic of Tatarstan territory and a corresponding value added producing is supposed to lead to creation on the Republic of Tatarstan territory part of a regional petrochemical cluster via organizing and supporting close interaction and cooperation between huge industrial enterprises, occupied in this sphere, SME and educational establishments. The major part of the project revenue constitutes revenue from real estate operations. That is rents and real estate buy out income. Beside real estate operations revenue the developer get profit from utilities and additional services providing. Management Team The company is led by 54301 and Airat Gizzatullin. Both persons being professional economists, their chief career objective may be identified as becoming the leading professionals in the field of property management and company restructurization. These two are inclined to put much effort in integrating Russian way of property management into international standards system, in order to make our inside real estate projects attractive for foreign investors. The company top-managers succeeded in forming a highly professional team of experts working on the project development. All the team members are persistent, enthusiastic about exploring new horizons, success-oriented and stress-resistent. 1.1. Project Objectives 1. The Kazan city planned industrial real estate market share by the 5th year of project realization constitutes 25%. 2. Rents pick of $37,8 mln. in the 5th year of project realization. 3. Project NPV is $167 mln. 4. Net profit/sales to be positive by the 7th year of project realization. 1.2. Keys to Success 1. Compliance with world latest achievements in industrial property development. 2. Governmental support via reasonable utilities prices retention and tax remissions providing for regional petrochemical industry development. 3. A comprehensive range of services along the whole value chain. 2.0. Project OpportunityThough a number of real estate market players is by the moment a considerable one and there constantly appear new entrants, the local (and even Russian on a whole) real estate market is an emerging one where the major working principles are just being established (which is explained by such a market absence in the former USSR, and its formation start after the USSR disintegration). The most developed part of this market is at present moment office and trading space lease market. As far as industrial real estate lease is concerned, it may be identified as a completely new product (service) to the local market. The grounds of this phenomenon may be described as follows: 1. till the USSR disintegration there existed mostly huge industrial governmental enterprises in the country; 2. right after the disintegration until recently the establishing local companies were mainly occupied in services industry and trade industry, since the profit margins were high in those sectors of the country economy; 3. nowadays the economic situation has shifted, due to change in people’s consciousness, to a larger number of small industrial enterprises establishment and their successful work at local and even international markets. But small and medium-sized enterprises lack appropriate production facilities ready for lease, and very often the production is organized in premises not intended for those purposes. All the enumerated factors prove the mature necessity for local industrial parks establishment. Such institutions are common to European countries, e.g. in Germany there exist 53 industrial parks in the chemical industry only, but in Russia these are only emerging and pure innovative. The challenge of the project consists of several aspects: 1. The industrial site neglected “sorry state”.

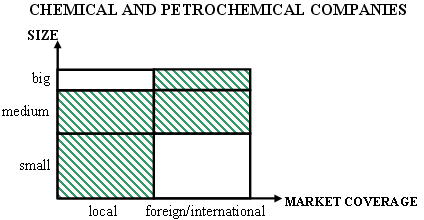

2. Absence of regional experience in managing industrial property, since till recently there was no necessity to professionally develop and manage the industrial property and, moreover, there were no property complexes, assigned for more than one client, to manage. Industrial parks are new phenomena to Russian market and we are going to make the best of the opportunity. A company capable of establishing a working pattern of an industrial park in Russia has all the probability to become leader to the market, gaining a substantial measure of control in the market place; attaining pioneer status; blocking competitors and achieving above average sales/profit growth. The investment needed for site redevelopment (utilities reconstruction and new construction of 600 thousand sq.m industrial and 150 thousand sq.m office premises amounts to $390 mln., including $15 mln. of front-end investment. The project payback period constitutes 7 years. We expect, that by the 10th year of project realization over 250 companies with 10 000 total number of workers will work within industrial park territory. 3.0. The Market AnalysisAccording to Jones Lang LaSalle Survey “Moscow City Profile”, dated September 2006, “the commercial real estate market in Russia has become more transparent for global investors. The market has entered a new tier in the Jones Lang LaSalle Global Transparency Index, placing it in the same league as Israel, South Korea and Thailand. Market entry of large scale Western European banks and lending institutions suggests that this positive trend will continue over the medium term”[1]. Generally, investment in real estate assets market in Russia’s regions dominates the regional investment market. The growing demand for rental spaces is a major force driving rental spaces growth. The Moscow and St.Petersburg markets are close to saturation, and rental premises boom has started in the regions. Kazan belongs to 13 Russia’s cities with a population over a million people. So the trends of Moscow’s and St.Petersburg’s office markets find quick response at the Kazan market as well. Nowadays high rental level, constantly increasing number of companies rivalling for rental spaces make Kazan real estate market an attractive industry to act in. A brief analysis of the Russian real estate market under the Porter’s diamond model: Firm strategy, Structure and Rivalry. Being a developing market, the Russian real estate market possesses one not a positive characteristic, consisting in absence of strategy of the first entrants to the real estate market and market analysis. Nowadays, however, the companies turn to development according to the all-over-the-world established rules. Nevertheless, local companies are hardly capable of competing with international market players. Demand conditions. The customers on the local real estate market are becoming more and more scrupulous and demanding. But globally, demand in Russian real estate market continues to exceed supply, leaving opportunity to compete. Factor conditions. The Russian real estate market is characterized by lack of professional specialists (“skilled labour”); lack of infrastructure, caused by mainly adaptation of existing old buildings, instead of building new ones according to the international standards; and a growing amount of capital invested in real estate development. Related and supporting industries. This factor is also uncultivated within Russian real estate market framework. E.g. there exist only 3-4 facility management companies in Kazan city, which is obviously scanty for a city with a population over 1 000 000 people. Real estate consultants and real estate agencies are till present moment also rare in the market. In two words, the Russian real estate market lack of development seems to prevent the country market players from entering international market for at least 10 years more. 3.1. Market Segmentation The limitation of “Himgrad” Industrial Park target customers to small and medium-sized companies occupied in chemical and petrochemical industries is made in order to single the project out of other industrial real estate complexes. The petrochemical utilities infrastructure present on the site territory allows increasing the efficiency of the mentioned companies business. The chart defining the target companies more precisely is presented at Graph 1. Graph 1

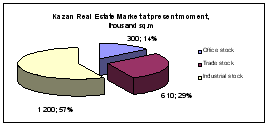

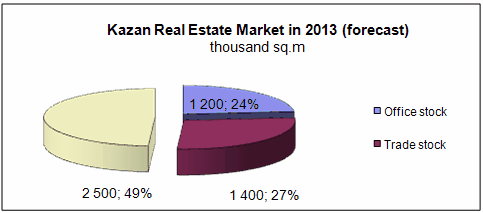

The hatched segments of Graph 1 represent the “Himgrad” Industrial Park target customers. The reason for excluding big local companies is in their possessing own production facilities on the Republic of Tatarstan territory and, accordingly, enough space for further expansion. As for small foreign companies, they are not interested in global expansion or, to be more exact, have not sufficient financial resources to perform such an expansion. Big foreign companies’ inclusion in our target customers may seem to be in contradiction with our strategic goals. Moreover, the site space of 131 hectares is not suitable for huge companies’ location. But here we primarily have in mind the location of small and medium-sized production facilities of such companies, which is usually the starting point of global expansion of an industrial company. Nevertheless, to make the location of such production facilities possible, we should address the mentioned companies’ headquarters. To sum up, the project has two categories of target customers: 1. local small and medium-sized companies, processing certain types of polymers, produced on the Republic of Tatarstan territory, including the newly-established companies; 2. foreign medium-sized and big companies, processing certain types of polymers, produced on the Republic of Tatarstan territory. 3.2. Competitors and Competitive Advantages The target customers have two-sided choice, deciding on their possible location. First, they may locate within industrial premises of Kazan city. According to the market research[2], by the end of 2007 Kazan real estate market comprises office, trade and industrial stocks in the proportions, presented at Graph 2: Graph 2

Kazan industrial stock comprises over 57% of all real estate premises available for lease, but only third part out of these 1 200 thousand sq.m is professionally developed (due to the above described reasons). But the site state prevents the immediate lease of all premises available. Hence, there exist opportunity for growth. But the target customers may also choose some other industrial park out of those developing in Russia (see Fig 1). Fig 1

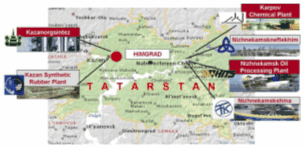

Main competitors group in Moscow and St.Petersburg regions. Tatarstan is beneficially located in Russia, on the boundary of European and Asian parts of the country, being the logistics juncture of those. So, the location of our industrial park in Kazan forms one of its competitive advantages, especially taking into account the chosen industrial park profile connected with the republican economy peculiarities. The location of “Himgrad” Industrial Park in Tatarstan – one of the leading Russian regions in chemicals producing and processing, automatically makes it close to Russian largest producers of polymers: Kazanorgsintez plant; Nizhnekamskneftekhim plant; Kazan Synthetic Rubber plant; Karpov Chemical plant; Nizhnekamsk Oil Processing plant; Nizhnekamskshina, etc. (see Fig 2) Fig 2

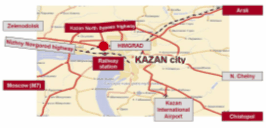

Such a location forms an additional advantage for companies occupied in the target industries, since they tend to locate their production facilities close to processed raw materials producers, and the main raw materials processed by chemical and petrochemical companies comprise certain types of polymers (polyethylene, polypropylene, polystyrene, polycarbonate and some others). Furthermore, the site logistics is perfect (see Fig 3). The industrial park is situated in the north-west part of the city, within close proximity to Kazan major traffic routes (highways and railway station (incl. railway lines within site territory). The site has convenient access approaches. The Kazan international airport is just 30 minutes away by car. Fig 3

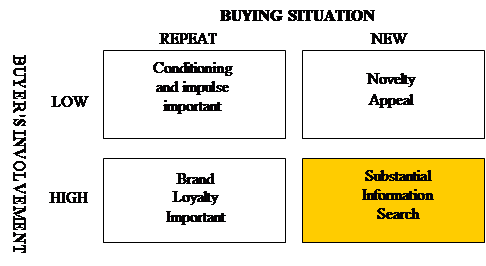

The last circumstance is of benefit in comparison with both local industrial property complexes and with other industrial parks in Russia (since not every industrial park or building has such a convenient location inside the industrial part of the city). 3.3. Target Market Segment Strategy According to the real estate consultants data, residents usually chose the premises of any type to lease (office, industrial or warehouses) according to the “classical” model of consumer choice process. The real estate choice presupposes high customer involvement and rational evaluation of all the factors (“thinking” rather than “feeling”). Little emotionality is possible while choosing the premises for the company’s headquarters or back offices, since these belong to the keystones of its future success and profit. The factor, intensifying the rationalist approach of the customer under analyzed circumstances to property choice, is the mentioned novelty of the product (service). A new buying situation (see Graph 3) here presupposes the customer’s substantial search for the information on the project by means of any available sources. Graph 3

In order to be a success, a developer ought to create an extremely attractive value proposition for the target customer, which should be based on the objective evidence (the site obvious advantages in comparison to other possible locations). Some of the “Himgrad” Industrial Park surface benefits include lower than the city average rents level, tax remissions, low utilities prices, etc. Another peculiar feature of chemical and petrochemical industries is that during the company’s location decision making process a huge number of technical details should be taken into consideration. The situation is easier if we deal with small companies, since the Decision Making Unit there may be limited to one person or few ones. In case of medium-sized and large companies, the Decision Making Unit consists of different people, or even companies’ departments, performing different roles in decision making process. Thus, the location or relocation decision is generally initiated by the company’s top management (which is mostly influenced by public relations media and is driven by brand and prestige); the deciders are commonly engineers and other technical specialists (which are driven by reason); the decision may be influenced by the company marketing or supplying department, which may assess the proximity to the company’s partners for the most, etc. Besides, there exist two time gaps in decision making process: 1. a gap between the point when the company realizes the requirement for location, relocation or further expansion and the point when the location decision is made by the company; 2. a gap between the point when the location decision is made by the company and the point when the location itself takes place. The second gap is conditioned by the technical complexity of the industries’ production facilities. As for the first one, the developer’s task is to prevent the customer’s withdrawal from the site, having taken decision in favour of some other location. And this becomes a challenging task, since the time gap may cover several months or even years sometimes. So, to make a bargain, the project developer ought to be able to answer the all departments’ specialists’ questions and satisfy all their needs and requirements. Moreover, the decision making process here takes much more time, and becomes a step-by-step procedure, when the developer has to conduct a successive series of negotiations with different specialist. When speaking about the second group of our target customers – foreign and international companies, we should bear in mind the necessity of keeping the services level to the international standards. Compared to local companies, having no choice of industrial parks in Russia, this group of customers is free to choose from other global locations – that is European, Chinese and American industrial parks and technoparks, having industrial premises. The competition on the global market is of a comparatively higher order than at the local one. Besides, there is another intangible benefit – the brand name, the company reputation and some other points of prestige. E.g. the global company presence at the site to a great extent increases its attractiveness for other potential residents. The authority, prestige and influence of the first site resident set the project general tone. At present moment the negotiations with some leading world polymers processors are held and actually their entrance to the site is one of our main aims at the moment, able to increase the further promotional efforts. The neglected state of the territory presupposes our obvious inability to attract the residents at the moment of the project’s initiation. Hence, at the initial stages of the project development the site could not be developed according to “build-to-suit” concept, when the developer holds preliminary negotiations with potential residents, signs binding lease agreements with them and develops the land plots or buildings according to these very residents’ requirements; it could rather be “spec building”, when no binding lease agreements are signed, and the developer improves the site state at his own expense. 3.4. Market Trends and Growth To formulate a prospective business plan, we should assess the target market development trends. Russian economy today experiences rapid growth, the number of investment projects grows from years to year, and the corresponding investment amount increases as well. Thus, investment growth in 2007 exceeds 17.4% comparing to the previous year. The “Himgrad” Industrial Park prospects depends on both real estate and petrochemical markets development trends. Russia's commercial real estate sector is currently the fastest growing in the world and will retain the direction to further extensive and intensive growth. The first one is connected with the increase in premises total square, the forecast of which is presented at Graph 4. The intensive growth comprises the premises quality improvement and their compliance with internationally excepted standards. Graph 4

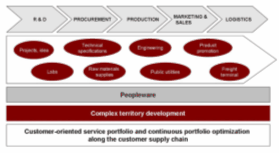

As for the chemical industry, in which work our target customers, it also experiences considerable growth at present time. So, the investment in chemical products is 2.6% of total investment in Russia in 2007. The annual production volume in Russian chemical industry in 2007 amounts to $34.7 bln. (growth rate is 10% compared to year 2006). The corresponding number for the Republic of Tatarstan chemical industry is $3,8 bln. with growth rate at 16% level. According to the analysts’ estimates[3], the specified trend will extend for the following five-seven years. So, the growth in chemical industry will provide the growth of our target customers, occupied in chemical business. 4.0. The PropositionThe project developer aims at creating new for the region establishment – an institution, providing a juncture of production and service facilities, which intensify the site residents development. The purpose is to be achieved by means of reconceptualization, reconstruction and redeveloping to meet the state-of-the-art economic conditions requirements. A suggested positioning statement may be formulated as follows: “Himgrad” Industrial Park is one of the best possible locations for both small and medium-sized companies, providing a comprehensive services range along the entire customer value chain at comparatively low prices”. So, the residents of the industrial park will get a complex product consisting of: 1. premises for lease; and 2. a range of services provided to residents as an essential and integral part of it. Generally, the range of services provided to industrial parks residents is much wider than a usual scope of services for other types of leased property. If we speak about the comprehensive range of services, the concept of the “Himgrad” Industrial Park is focused on providing core (directly connected with the residents’ manufacturing process, such as property management and complex energy supply) and additional services along the whole customer supply chain (see Fig 4). Our mission is to provide companies in the industrial park with the infrastructure and customer-centric industrial services they need to focus fully on their core business. This circumstance enables to boost the competitiveness of both the industrial park and the tenant companies. We aim at creating favourable conditions (including e.g. tax remissions) for regional petrochemical industry development, by means of combining within one territory research and development, production, marketing & sales and logistics facilities providing a comprehensive range of services along the whole value chain for site residents Fig 4

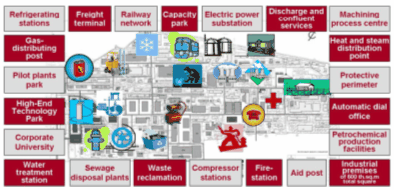

The complete technological infrastructure of the industrial park will serve the needs of the resident companies. The technological infrastructure (see Fig 5) comprises refrigerating stations, freight terminal, railway network, capacity park, electric power substation, machining process centre, gas-distributing post, pilot plants park, high-end technology park, corporate university, water treatment station, sewage disposal plants, compressor stations, fire station, aid post, heat and steam distribution point etc. Fig 5

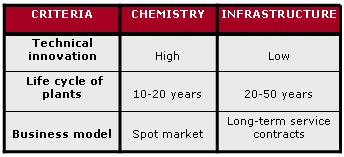

Our company aims at creating a unique business environment, assisting the residents in their efficient development. The effect is achieved via providing a number of intangible benefits to the residents. That is the compliance of our strategy to residents’ development strategies, aiming at creating possible synergy from residents’ interaction (the chance of finding future business partners and contractors increases, when, like in our industrial park, there exist both developing and mature companies), and employing authoritative resource, which becomes possible due to our active and close interaction with the Republic of Tatarstan government. 5.0. The Business ModelOur business-model is based on a global trend of separating infrastructure from chemical companies core business. Infrastructure is no more chemical industry core business, neither a supplementary part of it. The difference between the very nature of these two spheres of activity is so immense, that they hardly can go together (see Table 1). Table 1

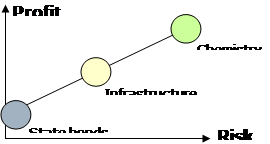

The infrastructure providing business is less risky, than that in chemistry and petrochemistry producing. The profits are less than those in chemical industry (see Graph 5). Graph 5

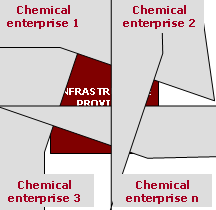

Moreover, since the business is a specific one, it needs some special production facilities, assigned for chemistry. These are usually expensive, and not every small company can afford these. That’s why industrial parks are a good decision for small and medium-sized companies, since in industrial parks they may concentrate around one infrastructure providing company and keep in mind only their core business, as presented at Fig 6.

Fig 6 6.0. Sales & Marketing6.1. Promotional strategy The objective of our communication is in attracting potential residents for location within the site territory, which provide us with at least two constant sources of profit: rent payments and payments for services provided. If we consider the local companies (whatever their size is), both advertising and public relations work efficiently for promotion. Another characteristic feature here is that we intend to spend less money on advertising, paying more attention to public relations, which comprise non-paid communication effort, such as press releases, speeches at industry seminars, appearances by firm executives on radio and TV, etc. These media are extremely influential with customers, and in case of proper organization may save a lot of money, resulting in the same effect for the site development. As for foreign companies, the publicity vehicle is hardly applicable, since it needs a lot of time and effort on the part of a developer, the immediate presence (providing personal contacts at different levels of business and political communities) at the global market let alone. So, the main emphasis in this case should be made on all types of advertising (internet, specialized magazines and other infomercials) and on promotion by means of participation in exhibitions and conferences on the subject of industrial property, since these are often attended by potential site residents. The main principles underlying the “Himgrad” Industrial Park promotional strategy may be formulated as follows: 1. it should be aggressive, speedy and efficient in order to leave the competitors behind, to gain the vacant market niche, and to persuade the target customers in all the benefits they may gain from accommodating at the industrial park territory, the location unfamiliar to them before; 2. not a single promotional strategy should be created, but at least a two-sided one, each part of which aiming at covering one of the groups of the target customers; 3. the basis of the promotional strategy is in underlining the rational benefits of the site as target resident possible location; 4. the promotional strategy should be comprehensive and all-penetrating; 5. stableness and sustainability should become integral features of the promotional strategies. The developer should bear in mind the necessity for the promotional strategy to inform the target customers and to keep the information up-to-date, constantly reminding the target audience of the site, its benefits and whatever else needed; 6. the intangible benefits should be put on one of the frontlines of the project positioning; 7. international experience of industrial parks operation and management should be scrutinized and taken into account, making stipulation to the local market peculiarities. The recommendations on the promotional strategy may be tabulated, the stipulation made that we consider the two promotional sub-strategies, aimed at addressing two groups of target customers (see Table 2). Table 2

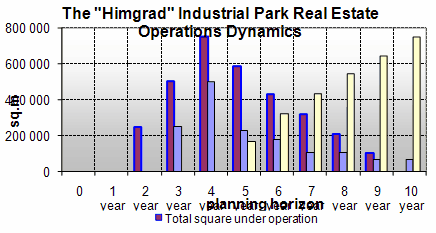

The table may serve as a core element of the “Himgrad” Industrial Park promotional strategy and an assessment medium for the steps taken by the company specialists in that direction. A very important point is that the division of the project promotional strategy into two substrategies does not mean their absolute separation from one another. All the marketing communications program should be unified in terms of style and general principles of execution. The main thing in the two substrategies separation is to concentrate on the criterion, which is of high-priority to the target group. For potential residents it is the level of their convenience, first, and the economizing effect as well (saving on taxes, on utilities prices and on rent level). Another point, obligatory to mention, is connected with the promotional efforts efficiency evaluation. The problem here is that we cannot assess the short-term efficiency of our efforts. The reason for this is, predominantly, the above described time gap between the point when the company realizes the requirement of location, relocation or further expansion and the point when the location decision is made by the company. Under such circumstances one cannot assess exactly which of the promotional efforts have led the potential resident to the site – it may be equally e.g. an advertisement in a last year’s special industrial magazine, a name card of the company representative with a note “important” or “interesting” found somewhere, a web-site, an article in a local newspaper, a meeting at a specialized conference, etc. Thus, the provided in table measurement media have a relative character. Nevertheless, they may serve as indirect promotional strategy assessment ratios. Generally speaking, the main thing about the market under analysis is a very high price for any mistakes in the project promotion. So, every step taken should be thoughtfully considered and assessed. Furthermore, since the customer tends to search for information everywhere, the promotional strategy should be carried out by means of different media channels, including even such as rumours sometimes. Considering the promotional strategy budget, the important point here is that due to the peculiar feature of the industrial property lease process, the general concept lies in attracting the customers, not in their further retaining. So, the sums of money spent on promotion at the initial stages of the project development (2008-2009 financial years) are considerably larger than the following periods’ budgets. Thus, we expect that on the first stages of the project development the promotional budget will amount up to $350-450 thousand per year. The supporting marketing strategy will cost $100-150 thousand per year. 6.2. Sales Strategy With the forecasted market growth (see Graph 4, paragraph 3.4 of the current document) we plan to occupy the fourth part of Kazan industrial real estate market by the 4th year of project realization (600 thousand square meters of the forecasted 2 500 thousand sq.m total market capacity). The real estate operations concept of the “Himgrad” Industrial Park comprises the three main steps: 1. new construction of industrial premises; 2. long-term lease agreements signing with site residents, and 3. optional buying the leased premises out, after expiration of the lease agreement at will of the residents. The dynamics of these three types of real estate activity is presented at Graph 6. The positions of total square under operation and total square sold are cumulative.Graph 6

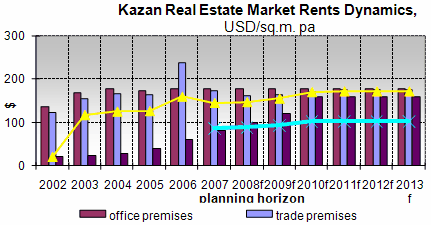

The rent rates policy of the “Himgrad” Industrial Park is based on our attempt to create favourable conditions for site residents. Thus, we have analyzed the Kazan real estate market rents (see Graph 7) and set the site rents at a level lower than the city average market rents. Graph 7

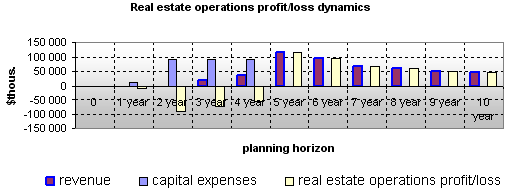

In addition to premises lease and buy out, the “Himgrad” Industrial Park provides utilities (gas, electricity, water supply, heat supply etc.) and additional services (such as marketing services, consulting, law support etc.). The dynamics of providing both types of services directly depends on the amount of premises lease and buy out and will be examined in paragraph 7.2 of the current document. 7.0. Financial Forecasts7.1. Important Assumptions While assessing the project financial data, some underlying assumptions were made: 1. inflation rate is taken 11%; 2. rent rates, utilities prices and additional services prices growth estimation is based on the specified inflation rate; 3. discount rate is taken 14%; 4. a growth trend in the Kazan real estate market is expected. 7.2. Project Earnings Structure At Graph 8 the financial result of the main activity of the “Himgrad” Industrial Park is presented – that is real estate operations, including lease and real estate units buy out. Graph 8

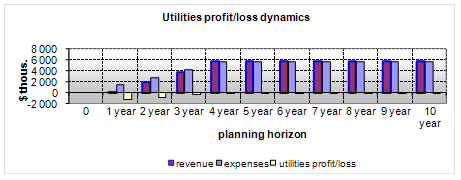

As we see from the graph, the positive financial result in this type of activity appears in the 5th year of project realization, after all the real estate units are put into operation. Graph 9 represents the financial result of the utilities providing activity. The financial result here is the minimal positive. This is conditioned by the preferential utilities prices on the industrial park territory. One more circumstance restricting the utilities pricing policy is that this economy sector is controlled by the government and antimonopoly institutions. This type of activity is necessary for the residents, but non-profitable for the company. Nevertheless, low utility prices will provide the site with a greater customers’ inflow. Graph 9

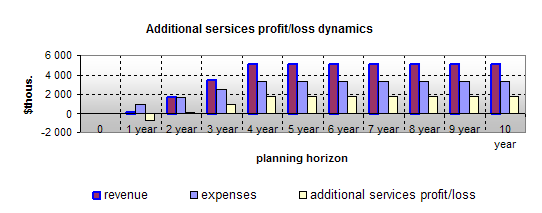

Another profitable type of activity, except the real estate operations, is providing additional services (consulting, law support, marketing, technical permissions etc.). The financial result of this type of activity is presented at Graph 10. Graph 10

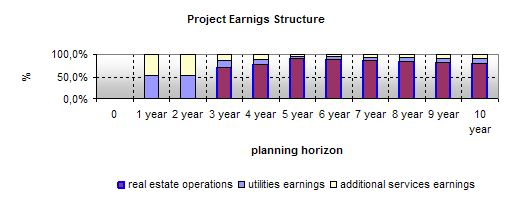

If we consider the total project earnings structure, it will look as follows (see Graph 11). Graph 11

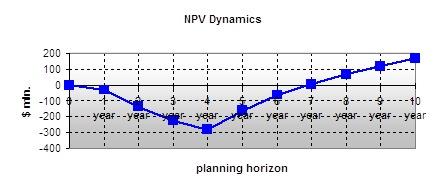

The real estate operations form the bulk of the project earnings, comprising up to 80% of all earnings structure. 7.3. Net Present Value Analysis The Project Net Present Value is presented at Graph 12. According to the Graph, the accumulated project NPV is $167 mln. by the 10th year of project realization. Net profit/sales are expected to be positive by the 7th year of project realization. Graph 12

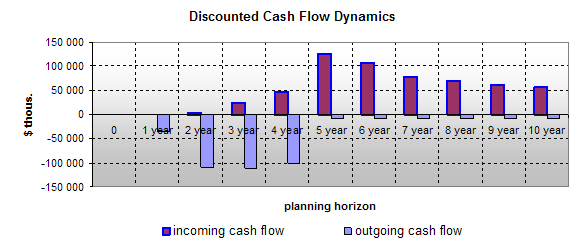

7.4. Projected Cash Flow The Project Cash Flow Dynamics is presented at Graph 13. The positive discounted cash flow in the 5th year of the project realization is conditioned by the total amount of real estate object putting into operation and being leased from that point of time. Graph 13

7.5. Key Financial Indicators · Redevelopment site size 131 hectares · New construction 750 thousand sq.m o industrial premises 600 thousand sq.m o office premises 150 thousand sq.m · Total investment amount $390 mln. o Front-end investments $15 mln. o Investment in utilities reconstruction $30 mln. o Investment in new construction $345 mln. · Planning horizon 10 years · NPV $167 mln. · IRR 21% · Payback period 7 years · Number of resident companies 250 · Number of workers (residents included) 10 thousand · Residents’ expected annual production volume $ 100 mln. (when at full capacity) 8.0. Company Profile Name of the company: Joint-Stock Company “Idea Capital” Asset Management” Establishment date: July 2004 Core competence: asset management, property management in particular

1. “Idea” Technopark, Kazan city · main areas: innovative production ·

· 88 companies · over 700 workers · 2006 annual production volume is approx. $15 mln. · anchor tenants: DHL Express, McDonald’s, Siemens, Citybank etc. 2.

· main areas: agriculture, petrochemistry · 40 150 sq.m · 100 projects under realization 3. Kama Industrial Park “Master”, Naberezhnye Chelny city · main areas: automotive components · 138 000 sq.m · nearly 100 companies · approx. 1 500 workers · 2006 annual production volume is approx. $30 mln. · 8.1. Management Team The company top-manager are general manager 54301 and chief operating officer Airat Gizzatullin. After graduating from Kazan Institute of Economics and Finance in 1997 and completing the Certificate in Presidential Management Training Initiative Program with practical work at California State University Hayward in 1999, 54301 got the degree of Ph.D. in Economics in 2001. 54301 has a wide experience of working successfully in both commercial enterprises and in governmental authorities (TDT-Invest Company general manager, Deputy General Manager of the Agency for Enterprise Development of the Republic of Tatarstan, First Deputy Prime-Minister of the Republic of Tatarstan Counsellor in economics, Innovative Technopark “Idea” chief financial executive etc.). Airat Gizzatullin has also graduated from Kazan Institute of Economics and Finance, a year later than 54301. For a ten years period Airat has proved to be a born leader, possessing a broad outlook, equipped with a practical experience in business-centers operating, real estate and antirecessionary management. The team of experts working on the project development consists of highly professional people. The main advantage of the team formed is that most team members have successfully worked together on other projects, e.g. Innovative Tecnhopark IDEA creation, development and promotion. They work together for two years approximately and have proved to be a real team, creative and efficient. So, the team is capable of solving difficult tasks and working under pressure. The team members are presented at Fig 6. Fig 6

8.2. Management Team Gaps and Personnel Plan At present moment the team lacks specialists working with site residents. This is the problem to be solved no earlier than in the next two years, while the first real estate units are being constructed. Nowadays the stress is made on working out the main principles of the industrial park functioning and on project promotion. Besides the people directly working with residents, providing them with lease services, after the real estate objects are put into operation the company will need a special facility management department which will observe the technical condition and engineering status of the property units. At present moment our personnel amounts to 120 people, 30 of them being managerial staff. By the 5th year of project realization, when all the planned 600 thousand square meters of constructed property will be put into operation, our staff will amount to 1 500 people, most of them being occupied in facility management and technical support. Risks1. Overall political situation in the country is still a bureaucratic one, which may be of negative influence on the project development in terms of its orientation on market economy principles. Even now, in 2007 in Russia we deal with coordinated market economy, rather than a liberal one. The role of government bureaucracies and powerful interest groups is predominant. Cross-shareholding and long-term relationships, based and monitored on private preferences (not on market relationship) are also common to the market. The specific features of such a type of economy intensify with going deeper from Moscow to the regions. And the Republic of Tatarstan is not an exception to the rule. Besides, the fact that the main part of population is Tatar – people with different culture and customs, adds some specific character to the region. That is why many visitors from Moscow and St.Petersburg compare coming to Kazan with going abroad. 2. The mistake in promotional strategy may tell negatively on the project long-term success, since the short-term efficiency of our promotional efforts is hardly assessable. Such a circumstance does not permit to form balanced forecasts, as in physical commodities market and even in most service markets. The problem is connected with the specific characteristics of the target customers, i.e. their occupation in production sphere, where there exist a considerable time period for taking decisions for location and/or relocation, lasting for years in some cases. 3. One more risk is connected with the macroeconomic situation on free oil market. The possible fall in oil prices will, first, decrease the money inflow in Russia, restricting all the economy branches development (real estate including) and, second, the petrochemical and chemical industries will suffer most, being directly dependent on oil prices. Thus, the development of small and medium-sized petrochemical companies will shift into low gear, depriving the “HImgrad” Industrial Park of its target customers. [1]http://www.research.joneslanglasalle.com/loadpage.asp?document_lang=29&countryid=130&location=/showdocument.asp [2] http://www.arenda-kazan.ru/reseach [3] http://www.economy.gov.ru/wps/wcm/connect/economylib/mert/resources/1d19c20047ee07b0a1fdb32cf23fafaf/oznakomitsya.doc |

Objects under operation:

Objects under operation:  20 000 sq.m (approx. 8% of Kazan office market)

20 000 sq.m (approx. 8% of Kazan office market)

“Idea-South-East”

Technopark, Leninogorsk city

“Idea-South-East”

Technopark, Leninogorsk city